The Japanese Art of Saving Money

Kakeibo: The Japanese Art of Saving Money—It’s Not About Deprivation, It’s About "Awareness"

Kakeibo: The Japanese Art of Saving Money—It’s Not About Deprivation, It’s About "Awareness"

Many people try to save money by aggressively slashing expenses or putting themselves under immense pressure, which often leads to burnout. Kakeibo, however, is a traditional Japanese financial philosophy that invites you to stop asking, "How much did I spend?" and start asking, "Did this purchase actually bring me joy?"

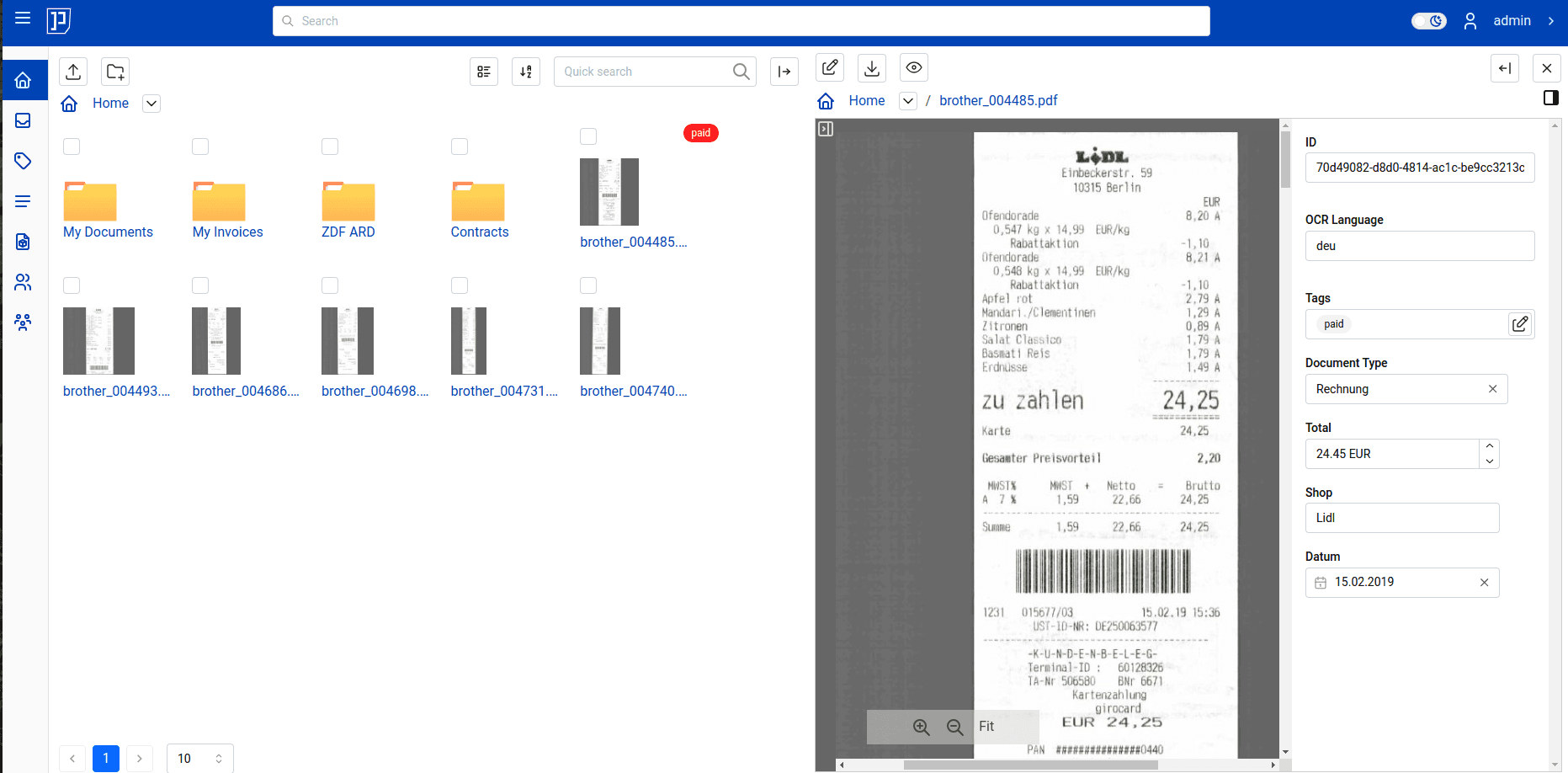

##What is Kakeibo? Kakeibo (pronounced kah-keh-boh) translates to "household account book." At its core, it is the art of handwriting your income and expenses. It emphasizes mindfulness and emotional reflection every time money leaves your pocket. The goal isn’t to restrict yourself, but to gain a crystal-clear understanding of your own spending habits.

##The Heart of Kakeibo What sets Kakeibo apart from standard accounting is the shift from "numbers" to "feelings." It encourages you to question your spending gently, without judgment or self-blame.

##The 4 Pillars of Kakeibo To begin, you must answer four fundamental questions: How much income do you have this month? Record all your reliable sources of income. How much would you like to save? Kakeibo teaches you to "save before you spend." Set a realistic goal and set that money aside immediately. How much are you actually spending? Calculate: Income – Savings – Fixed Expenses. The remaining figure is what you can spend freely—guilt-free. How can you improve next month? Reflect on which expenses were unnecessary or excessive, so you can lighten your financial load moving forward.

##A Step-by-Step Guide to Practicing Kakeibo

- List your total monthly income Include your salary, side hustles, and any extra bonuses.

- Deduct savings and fixed expenses first Think rent, utilities, internet bills, and any recurring subscriptions.

- Categorize the remaining "spending money" into 4 pillars: Survival: Needs like groceries and transportation. Optional: Personal pleasures like shopping, movies, or cafe hopping. Culture: Investing in yourself, such as books or workshops. Extra: Unexpected costs like car repairs or gifts for others.

- Reflect and Review at the end of the month Look back at where your money went and ask yourself which purchases truly made you feel good.

The Kakeibo Trick: Writing by hand is key. The physical act of writing helps you remember the "feeling" of spending, making you more mindful and intentional in the months to come.

👉credit: B2S CLUB